Wed May 6 17:52:29 2020

<5547a085> I keep getting drawn into the higher frequencies, but the chop is murder

<8f79fcda> <https://youtu.be/0zH_352t8tQ?t=25>

— Dropship – All Unit Quotes – StarCraft: Remastered

<8f79fcda> <@U07MMSG8M>

<8f79fcda> and look at that price lol

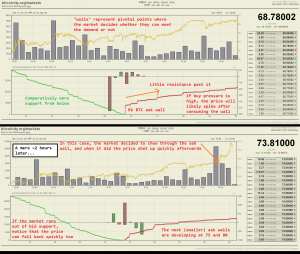

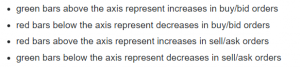

<7d56dcb3> am i the only one that doesn’t trust order books?

<7d56dcb3> ie i’m sure there are tons of orders on people’s computers not on the books just waiting for a certain price to hit

<8f79fcda> if you’re talking about the worst abuses of an open market orderbook – i trust that they aren’t to be trusted

<8f79fcda> and fuck yea

<7d56dcb3> or have exchanges transitioned to a maker-taker fee model?

<8f79fcda> depends on the exchange

<7d56dcb3> i remember some exchanges doing it

<7d56dcb3> but not sure if it’s caught on

<8f79fcda> we’ve got spoof orders, block orders, ham orders, fat fingers, long tongues, bait orders, knifecatchers, funnel trap spider orders… there’s so many names for the different types of order book formations

<8f79fcda> and that’s not even talking about the money line (price)

<8f79fcda> for price movement

<8f79fcda> we’ve got the bart simpson, cup and handle, waving flagpole, moon

<8f79fcda> <@U07MMSG8M> looks at candles so he probably has some other names for price trends/formations

<5547a085> the dick tease, the nipple flip, the honey wick

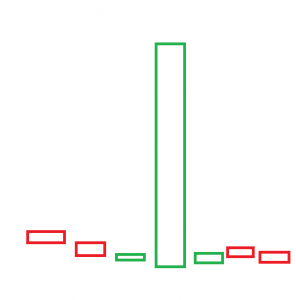

<8f79fcda> BGD candles

<5547a085> The BTFD face rip

<8f79fcda> (Big Green Dildo)

<5547a085> I look at volume on different timeframes (15M, 30M, 1H, 458M, 850M, 1D, 1W) and kind of zoom in and out to get a litmus of price direction

<5547a085> I have a tendency to start trading higher timeframes down to 1M which during certain trends can pay for hours (like yesterday), but then today during contention points will become a chop zone

<8f79fcda>

<5547a085> My 850M indicator just went long, but the 1H is short

<5547a085> 1:4 timeframes are the best match, but the 850M is a reliable macro, if I had respected it the entirety of the last month I’d have caught a lot more bids, but I get restless and cant stomach having positions open longer than 20 minutes, hence the tendency to catch higher frequency timeframes like 15M, 5M, 1M

<5547a085> I have to go longer term, and also wake up earlier

<5547a085> Its basically 4AM CST and 7PM CST where most of the larger directions seem to be decided

<5547a085> I’ve caught some high levered 1% moves that pay out handsomely, but then the fucking chop takes a lot of it away, I need to readjust my internal diatribe

<5547a085> So heretofore, I now publicly renounce 1M, 5M and probably also 15M timeframe trades

<5547a085> For the next 5 days

<8f79fcda> what are you going to do with all that time?!

<8f79fcda> lol

<5547a085> Thats where the horse tranquilizer comes in

<8f79fcda> time to drink corona

<5547a085> You just get in a sleep champer like that alien Prometheus

<5547a085> They didn’t say it in the movie, but that plot was basically him hypersleeping between galactic bids to unload all that space jizz in jugs on the galactic market

<5547a085> And Guy Peirce fucked it all up, so he rightfully killed them all

<8f79fcda> <@U2S98EDNK> price is harder to trust than order books imo

<8f79fcda> and order books have plenty of fuckery to go around

<8f79fcda> <@U2S98EDNK> on any given day i’d say there’s probably 1-2k meatbags globally that are actually and actively trading – everything else is bots